There’s an old joke about a gambler who calls his bookie late at night, desperate to place the next day’s bets. The bookie is furious and tells him to wait until morning. “It’s just a couple parlays,” says the gambler. “Oh,” responds the bookie. “Let me grab a pen.”

Parlays, also known as multis or accumulators, are wagers that combine two or more bets. For example, if the Yankees are playing the Cubs and the Knicks are playing the Lakers, one could create a parlay of the Yankees and Knicks, which would only pay out if both teams win.

Gamblers love parlays because they make it easy to risk a little and win a lot. Instead of betting on one very unlikely event users can bet on various semi-likely events and get the same longshot payout if they all occur.

Sportsbooks love parlays because the hold—the percentage of a wager the house keeps in the long run—is higher than straight bets, meaning they profit more. Last year, the University of Nevada’s Center for Gaming Research released a report showing that between 1992 and 2023, Nevada casinos had a hold rate of about 5% on normal sports bets. Parlays, meanwhile, had an average hold rate of 31%, meaning casinos profited $31 for every $100 bet.

Many people see high hold rates as evidence parlays are uniquely evil, and “stay away from parlays” is often the first piece of counsel on gambling forums. While this can be useful for beginners—if you have no idea what you’re doing, you will lose more betting parlays—it’s bad advice for those who actually want to understand how sports betting works. Parlays aren’t necessarily worse than other bets, they’re just a bit more complex. And when used correctly, they’re one of the most effective ways to make money betting.

How Parlays Work

Parlays take the stake and profit from one bet and roll it over completely onto the next. For example, a parlay on the Yankees and Knicks works by placing an initial wager on the Yankees. If the Yankees win, the gambler’s payout is then automatically bet on the Knicks.

On paper, that parlay will have roughly twice the hold of a bet on only the Yankees or only the Knicks. An average gambler should expect to lose $1 for every $20 bet on a standard straight wager, and $2 for every $20 bet on a standard 2-leg parlay.

But that isn’t a fair comparison, because the parlay is actually placing two wagers: one on the Yankees, and then another, bigger one on the Knicks (if the Yankees win). The higher hold rate, therefore, doesn’t come from a larger hold percent. It comes from the same hold percent on a cumulatively larger wager.

As Ed Miller and Matthew Davidow write in The Logic of Sports Betting, “Parlays don’t hold more. They make you bet more money.”1

What You Don’t Know Can Cost You

For most gamblers, betting more means losing more. Their parlays are filled with bad bets that compound the house edge and increase expected losses. There’s nothing inherently wrong with this; sports betting is entertainment, and if a few bucks on a juicy 5-leg parlay makes the night more exciting, it’s money well spent. After all, even the worst parlays usually have better payouts than scratch-off lottery tickets, and the high lasts longer.

Problems arise when recreational users don’t realize how much they’re losing—or think they’re winning. Bettors with a distorted view of their chances are far more likely to exhibit signs of problem gambling and lose unhealthy amounts of money compared to those who understand their bets are for fun, and likely won’t turn a profit.

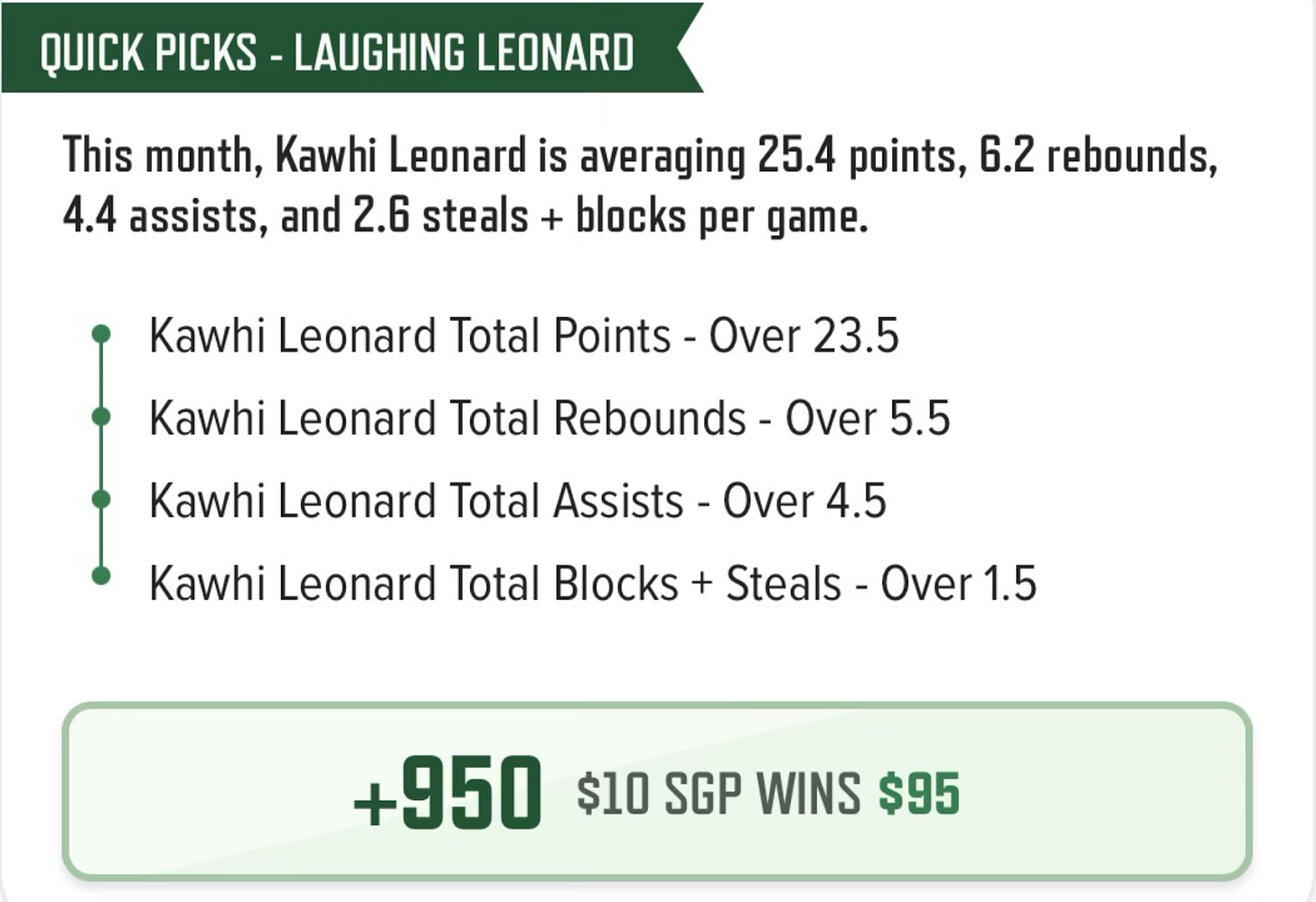

This is especially true for same-game-parlays (SGPs), which combine bets from a single game. These wagers—such as the Yankees to win, Gerrit Cole to have 8+ strikeouts, and Aaron Judge to hit a home run—are very difficult to price and often very unlikely.

That combination of complexity and rarity allows books to add a large additional hold, often without users noticing. Since their introduction a few years ago, SGPs have become the most popular and profitable bets at most sportsbooks, and frequently have hold rates of 30% or higher.

Sportsbooks know SGPs are their biggest money makers and promote them heavily. Celebrity partners tout custom bets, sites highlight recent statistics that make wagers more enticing, and sportsbook social media accounts regularly post big SGP winners.

Betting companies maintain they’re marketing an enjoyable product to consenting adults. To an extent, this is true. Fanduel isn’t forcing anyone to place a bet on the Celtics to win and Jayson Tatum to score 30+ points, and most users know the odds are skewed in the house’s favor.

But sportsbooks don’t just blindly push SGPs. They target the customers least informed about how bad the odds really are. In May of 2022, Draftkings’ chief financial officer noted the company was looking to “serve up [SGPs] to players who have a proclivity to engage with that type of bet.” In their February 2024 Letter to Shareholders, he attributed “exceptional unit economics”—how much each user lost—in part to “surgical promotional tactics on a customer-specific level,” including promos incentivizing parlays and SGPs.

Some in the industry view this as unsustainable. Jeffrey Benson, director of sportsbook operations at Circa Sports, which relies on a large volume of bets rather than on wide margins, told The Wall Street Journal last year, “They’re price gouging their customers, to put it mildly, jamming parlays down their throats.”

It’s Different for Winners

For most gamblers, parlays generate larger losses as negative edges compound. But for profitable bettors—those who place wagers with a positive expected return—the opposite is true, and parlays can increase profits by compounding a positive edge.

Imagine two sports bettors, Ben and Aaron. Ben bets for fun, and wants to wager on his two favorite teams, the Yankees and Knicks. Both teams are evenly matched with their opponents, and the sportsbook lists the odds at -110 (meaning a bettor needs to risk $110 to win $100, which would pay out $210 in total).

If Ben places a $110 wager on only the Yankees, he’ll get back $210 50% of the time, making his expected payout $105 (210*0.5). His expected % return is (105-110)/110 = -4.5%.2

If Ben places a $110 parlay on both teams, he’ll get back $401 25% of the time (the odds both teams win = .5*.5 = .25) making his expected return $100.25 ($401*.25). His expected % return is -8.9%.

Aaron, unlike Ben, is a professional gambler. He also wants to bet on two teams, the Dodgers and the Warriors, who are both listed at -110 odds. But he doesn’t want to bet on them because he’s a fan; he wants to bet on them because the prices one sportsbook is offering are off market.

Aaron saw that the Dodgers’ and Warriors’ opponents each just announced their star player is injured, and every other sportsbook has shifted the odds except for one. Instead of -110/-110, indicating a 50% chance for each team, other sportsbooks are quoting the odds at +115/-135, meaning they think the Dodgers and Warriors each have a roughly 55% chance of winning.3

If Aaron places a $110 wager on only the Dodgers at the slow sportsbook, he’ll get back $210 55% of the time, making his expected return $115.50 (210*.55). His expected % return is thus +5.5%.

If Aaron places a $110 parlay on the Dodgers and Warriors, he’ll get back $401 30.25% of the time (.55*.55 = .3025), making his expected return $121.30 ($401*.3025). His expected % return is +10.3%. While both of his bets had a positive expected return, meaning they’re profitable, the parlay is roughly twice as profitable as the straight bet.

Parlays can also help winning bettors blend in among the sea of losers. As Miller and Davidow write in Interception: The Secrets Of Modern Sports Betting, “parlays have an undeserved reputation as ‘sucker bets.’ Which means they’re great cover for the sharp bettor.” Since sharp bettors are always at risk of being discovered and kicked out by sportsbooks, such “cover play” is essential for maximizing long-run profit.

Variance and Risk of Ruin

One of the most important practices for all gamblers is good bankroll management. If you go to a casino with $500, regardless of whether you’re trying to make money or just have a good time, you probably shouldn’t wager all $500 on the first hand of blackjack.

There’s no exact answer for how much one should bet.4 But for both professionals and amateurs, it’s crucial to bet less on parlays and other wagers with long odds. Extended losing streaks are far more likely for longshots, and any gambler who risks too much on these bets will significantly increase the chance they go bust.5

The rise of these wagers—what author Jonathan Cohen describes as the “jackpotification” of sports betting—means that today’s bettors are more likely to speed through their bankroll, and go broke after an extended unlucky streak.

This is true both from a math standpoint and psychological one. A bettor who has lost dozens of bets in a row—which isn’t that unlikely if you’re betting longshot parlays—is more likely to become desperate and disillusioned, and exhibit symptoms of problem gambling.

Unfortunately, just as parlays can create these issues, they can also appear to offer the solution. As comedian Norm Macdonald famously quipped, “gambling is the only disease where you can win a bunch of money.” Parlays make this dream tantalizingly reachable, especially when social media is full of bettors showing how they turned $10 into $50,000.

It’s Bad that Gamblers are Bad at Math

Like most bettors, I love parlays and same-game-parlays. It’s fun to risk a little and win a lot, especially when you can sweat all the bets while watching a single game. But I know just how bad the odds usually are and do my best to minimize the house edge, for example by comparing the prices on different sportsbooks.

The problem with parlays isn’t that the hold is too high, or even that sportsbooks are deceptively promoting them. The problem is that most bettors don’t understand how they work.

Much of this is basic math. A common gambling post goes something like “I hate parlays, I always miss by 1 leg.” But if you bet on a coin landing tails 5 times in a row, you’ll win 1 every 32 times. If you bet on exactly ⅘ flips landing tails, you’ll win 5 out of every 32 times.

That means if you consistently place 5-leg parlays where each bet has a 50% chance of winning, you’re going to lose by exactly 1 leg 5 times as often as you are going to win all 5.

Of course, expecting all gamblers to be proficient in combinatorics is ridiculous. And even if we lived in that fantasy world, it likely wouldn’t dissuade most people from gambling on bets with bad odds. But a baseline level of gambling literacy should be a top priority for policymakers looking to protect against gambling-related harms—and for gamblers looking to come out on top.

The Logic of Sports Betting and its sequel Interception: The Secrets Of Modern Sports Betting are probably the two best books to understand today’s sports betting ecosystem.

The formula used to calculate % return is (expected payout - amount wagered)/(amount wagered).

To determine the odds of each team winning according to the sportsbook one can use a “Fair Odds” calculator, which shows the odds without the house edge. If the listed odds are +115/-135, the “fair” odds are +123.5/-123.5, meaning the favorite has a roughly 55.25% chance of winning (according to the sportsbook).

Professional bettors sometimes use the Kelly Criterion formula to guide them, but precise Kelly staking requires knowing the exact probability of bet winning which is always unknown. Moreover, Kelly betting only works if a bettor is actually profitable, which the vast majority aren’t. A general rule of thumb is to bet 1% of your bankroll on each bet, so if your bankroll is $1,000 each of your bets should be $10.

This is true even if one’s likely and unlikely bets have the same expected return, which they don’t. Parlays (as discussed earlier) and other longshot bets generally have lower returns, meaning bettors should stake even less.

Super helpful column. I almost understand how parlays work now!